End-to-end ESOP solutions for startups, private and listed companies

- ESOP Structuring

- Drafting of Scheme & Grant Letter

- ESOP Implementation

- Valuation & Administration

About Us

Affluence Advisory Private Limited is a leading ESOP advisory firm in India, offering end-to-end solutions for Employee Stock Ownership Plans (ESOPs) and other equity-based compensation strategies. With a strong focus on compliance, customization, and clarity, we help startups, private companies, and growing enterprises build ownership-driven cultures through well-structured and legally compliant ESOP plans.

CA Nimish Khakhar is a seasoned Chartered Accountant with more than 15 years of Experience in ESOP Advisory. He regularly serves as a visiting faculty at seminars conducted by the Institute of Chartered Accountants of India (ICAI) and other prominent industry forums, where he shares his in-depth expertise on ESOP-related matters.

About ESOP?

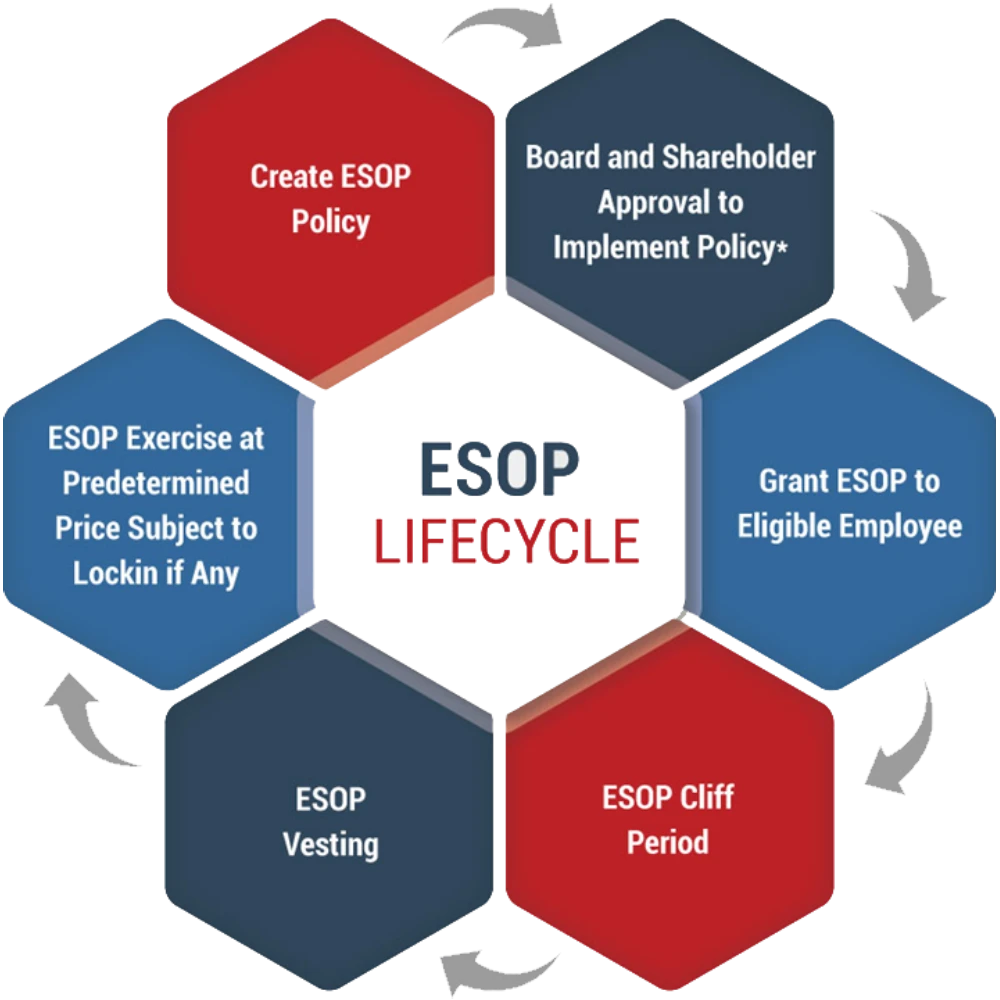

Employee stock Options means a right but not an obligation given to an employee which gives such an employee a right to purchase or subscribe at a future date, the shares offered by the company, directly or indirectly, at a pre-determined price. Employee Stock Option Plans/Equity Incentive Plans (commonly referred to as ESOPs) are one of the most important tools to attract, encourage and retain Employees. It is the mechanism by which employees are compensated with increasing equity interests over time.

Types of ESOPs options:

- 1. Employee Stock Option Scheme (ESOS)

- 2. Employee Stock Purchase Plan (ESPP)

- 3. Stock Appreciation Rights (SARs)

- 4. Restricted Stock Award (RSA)

- 5. Restricted Stock Unit (RSU)

Key Reasons for Implementing ESOPs

Attract, Reward, Motivate and Retain Employees

Enhances job satisfaction

Deferred compensation strategy

Good retirement benefit plan

Employees align with company’s goals

Key Terms used in ESOPs

- Grant: Offering of ESOP Options from Company to Employee. The company promises to give an employee a certain number of shares or options in the future, subject to conditions.

- Vesting:In very simple and general terms, vesting refers to the amount of time an employee must work before acquiring a certain benefit. When an employee is granted ESOPs, it means that he or she has the “right to purchase” the shares of the company subject to a certain timeline or criteria being met – this is referred to as “vesting” or “vesting frequency”.Vesting is therefore the process by which an employee becomes eligible to exercise his/her stock options and become a shareholder in the company.

- Exercise:In an Employee Stock Option Plan, exercise refers to the action an employee takes to buy the company’s shares that were previously granted to them under the ESOP.

Our Services

What Clients Say About Us

We appreciate their knowledge of Structuring the Scheme, SEBI regulations, Companies Act provisions, and Market Best practices in structuring ESOPs.

We particularly appreciate their ability to collaborate seamlessly with our internal teams and would recommend Affluence Advisory for exploring equity-based compensation strategies”

"We recently partnered with Affluence Advisory for ESOP implementation and ongoing administration, and the experience has been very good. The team ensured a smooth and compliant setup, and their support in managing grants, vesting, and documentation has been prompt and professional. Their expertise gave us confidence throughout the process."

Their team brought in-depth knowledge of SEBI regulations, Companies Act provisions, and best practices in structuring ESOPs for listed companies. From designing the scheme and obtaining necessary approvals to drafting documentation and aligning with investor expectations, their guidance was comprehensive, timely, and highly professional.

We particularly appreciate their ability to collaborate seamlessly with our internal teams and board members. Thanks to their support, we were able to implement an ESOP framework that is strategic, compliant, and aligned with our long-term value creation goals.

We would highly recommend Affluence Advisory to any listed company exploring equity-based compensation strategies.

Meet our team members

Nimish Khakhar

CA

CA Nimish Khakhar is a visionary leader and the driving force behind Affluence Advisory. With over two decades of professional experience, he has carved a niche in ESOP advisory, corporate structuring, and strategic business consulting. A trusted advisor to founders, CXOs, and boards, Nimish has successfully led end-to-end ESOP structuring, valuation, and implementation for startups, growth-stage companies, and listed entities. His sharp understanding of regulatory frameworks, combined with a practical, business-first approach, ensures that ESOPs are not just compliant but also strategic tools for growth and talent retention. Known for his integrity, clarity, and forward-thinking mindset, Nimish continues to empower organizations to build lasting value through well-crafted equity compensation solutions.

Bhavesh Chheda

CS

CS Bhavesh Chheda is a Practicing Company Secretary at Affluence Advisory, with in-depth expertise in ESOP regulatory compliance, and corporate governance. He has been instrumental in advising companies on end-to-end ESOP implementation, including drafting schemes, obtaining approvals, and managing disclosures. His practical approach and strong understanding of SEBI, Companies Act, and FEMA regulations make him a trusted advisor for equity-linked compensation strategies.

Payal Gada

CA

Payal Gada is a Registered Valuer (SFA) with Affluence Advisory, specializing in the valuation of shares and securities for ESOPs, mergers, and fundraising. She brings strong analytical skills and a deep understanding of valuation methodologies under regulatory frameworks such as the Companies Act, SEBI, and Income Tax Act. Payal has advised numerous startups and corporates on fair valuation for ESOP issuances, helping ensure transparency, compliance, and alignment with business objectives.